1. Executive Summary

-

The Resilience of Retail

-

Key Highlights

2. Rents and Rankings

-

Post-pandemic Rental Recovery

-

Europe: Regional Highlights

-

Americas: Regional Highlights

-

APAC: Regional Highlights

3. Global Trends and Insights

-

Global Economic Outlook

-

Cost-of-Living Crunch

-

Embedding Sustainability

-

Doubling Down on Experience

-

International Travel

-

E-commerce: Only One Part of the Equation

1. Executive Summary

The Resilience of Retail

Having come through the extraordinary times of the global pandemic, the retail sector has faced fresh challenges in the past year: higher (although easing) inflation, rising interest rates and slowing economic growth are combining to put consumers and retailers under sustained pressure.

Compounding these challenges is the ongoing question over the vibrancy of prime CBDs (downtown) as the “return to the office” remains lacklustre across many parts of the world, as well as international tourism not having fully yet recovered to pre-pandemic levels. The retail sector has continued to face these issues head-on while proving its resilience with the top 250 retail companies posting 8.5% growth year-over-year (YOY) in revenue, up from 5.2% in the previous year.1 Similarly, in the luxury sector, over 95% of brands reported profit growth2 in 2022, which continued into early 2023 with LVMH becoming the first luxury brand to reach a market capitalisation of USD 500 billion.

Although the luxury sector has slowed overall, luxury sales growth remains in positive territory as seen in recent Q3 2023 earnings results. The end of 2023 and into 2024 is likely to remain a challenging trading period but one that we are confident the sector can endure as it continues to evolve to meet economic and societal change.

The near-term outlook for the retail sector remains cautious, but at the same time is nuanced between subsectors and geographical locations. At the macro level, the focus is on the resilience of consumer spending. As central banks have undertaken one of the most aggressive interest rate hiking cycles in decades, consumers have shifted spending patterns and are reigning in non-discretionary expenditure. For the luxury sector, this represents a normalisation in their customer base after a period of strong fiscal stimulus, but as noted, sales growth is slowing.

On the other side of the ledger, costs are increasing. Debt is not only more expensive, but also harder to secure. Furthermore, despite the global economy slowing, labour markets remain incredibly tight which is fuelling wage growth pressure across much of the world. Such conditions present a difficult conundrum, which is readily evident within the physical real estate market. Similar to many major corporations, retailers are understandably reluctant to allocate large capital expenditure budgets at a time of slowing revenue and increasing costs.

Vacancy in super-prime retail locations remains tight, however, leading to competitive tension when these rare sites become available. Just this year, both Yves Saint Laurent (new lease) and Tiffany & Co. (expansion) secured or enhanced flagship stores in London and New York, respectively. In addition, there has been an expansion of European retailers into the U.S. and vice-versa, as well as an ongoing attraction by both to Asia Pacific’s growth prospects. Ultimately, navigating today’s market requires a considered approach to hone flexibility in the near-term, while maintaining focus on longer term strategic priorities. As there are limited opportunities to secure the best sites in a market, immediate near-term costs need to be balanced against the longer-term benefits these sites can bring, as well as the opportunity cost of not acting when opportunity arises.

Key Hightlights

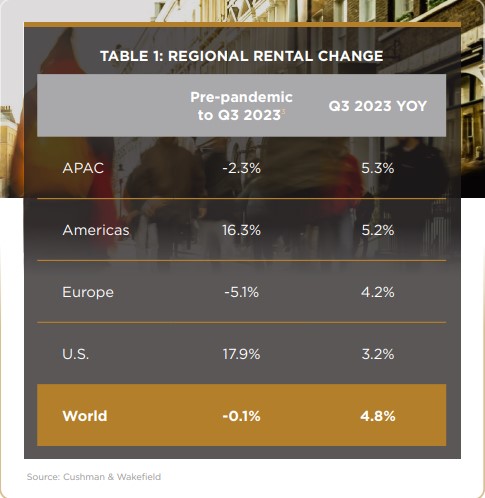

- – Rents across global prime retail destinations continued their ongoing recovery, increasing on average 4.8% in local currency terms over the past year. The strongest growth was recorded in Asia Pacific, which averaged 5.3%, with the Americas at 5.2% and Europe at 4.2%.

- – Notwithstanding comparatively strong growth over the past year, in most instances, the increase in rents did not match levels of peak inflation.

- – Furthermore, almost 60% of markets globally remain below pre-pandemic rental levels. This is most evident in Europe where 70% of markets are below pre-pandemic rents. In contrast, in the U.S., only 31% are below pre-pandemic levels; 69% are above.

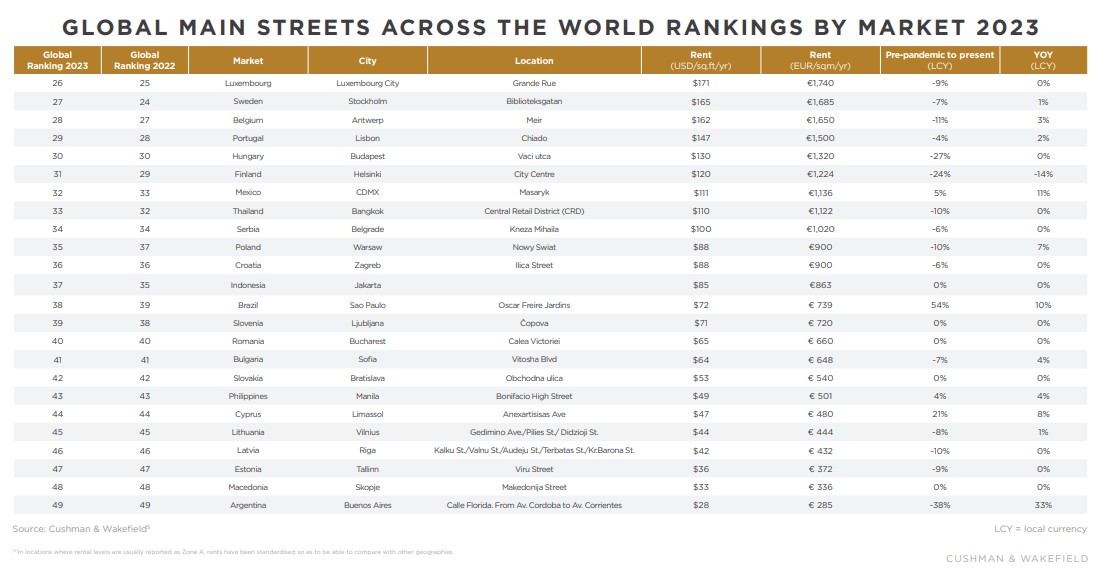

- – New York’s Fifth Avenue retains its top ranking as the world’s most expensive retail destination, despite recording flat rental growth year-over-year (YOY). Milan’s Via Montenapoleone jumped a spot into second, displacing Hong Kong’s Tsim Sha Tsui, which placed third.

- – New Bond Street in London and the Avenues des Champs-Élysées in Paris retained fourth and fifth positions, respectively.

- – The biggest mover was Istiklal Street in Istanbul, up from 31st to 20th position, as rampant inflation caused rents to more than double over the past year.

- – Downgradings were relatively limited, the most significant being Biblioteksgatan in Stockholm, which, despite rental levels seeing growth since last year, slipped three places from 24th to 27th globally, primarily due to the euro strengthening against the U.S. dollar more so than the Swedish krona.

2. Rents and Rankings

As the world continues to emerge from the impacts of the global pandemic, prime retail destinations similarly have continued their rebound, recording mostly positive rental growth over the past year.

Globally, rents rose by an average of 4.8% over the past 12 months, an increase over the 3.7% growth shown in the previous year. Asia Pacific led the world in 2023 at 5.3%, which was a strong improvement on the 1.1% growth experienced the previous year. Europe also accelerated from experiencing growth of 0.9% YOY in Q3 2022 to 4.2% YOY in Q3 2023, albeit driven by exceptional uplift in Türkiye (without which growth in Europe averaged 2.1% for the year). In contrast, the U.S. slowed from 17.0% last year, which was driven by supportive fiscal policies, to a more sustainable 3.2%.

While growth at the regional level was comparatively range-bound between 3% and 6%, there was considerable variation at the local market level. Rents in Istanbul increased by a staggering 120% over the past year. Rampant inflation in Türkiye, which peaked at 85.5% in October 2022 and is still travelling at 61.5% as of September 2023, has played a significant role which has been exacerbated by robust demand at a time of limited new supply. It should be noted that such growth is somewhat of an aberration, though Vietnam, Japan and India all recorded an average growth range of 12% to 18%.

Japan’s growth was driven by Midosuji in Osaka, while Banjara Hills in Hyderabad was the leader in India, recording rental increases of 60% and 40%, respectively. The former was driven by a strong rebound in international tourism, while rents in Hyderabad were coming off a relatively low base. At the other end of the spectrum, comparatively steep rental declines were evident in Chicago and Xiamen, both at -25%, with Shenzhen also recording a decrease greater than 20%. Indeed, analysis of markets with the greatest downward pressure on rents reveals that they are mainly located in the U.S. and mainland China, which together accounted for nine of the 10 bottom locations.

This is reflective of several economic headwinds currently operating in mainland China as the central government continues to introduce measures to stimulate growth. At the same time, new supply continues to enter many markets such as Shenzhen, Dalian and Xiamen which has generated competition to secure tenants. In the U.S., the picture is more nuanced; while parts of Seattle (CBD), Chicago (North Michigan Avenue) and Miami (Lincoln Avenue), all experienced strong rental declines, other locations within these cities such as Oak Street in Chicago and the Wynwood neighbourhood in Miami recorded growth of over 9% YOY as retailers relocated their premises to areas with greater vibrancy and foot traffic.

Post-pandemic Rental Recovery

Rental growth over the past 12 months has contributed to the retail sector’s ongoing recovery in the post-pandemic era.

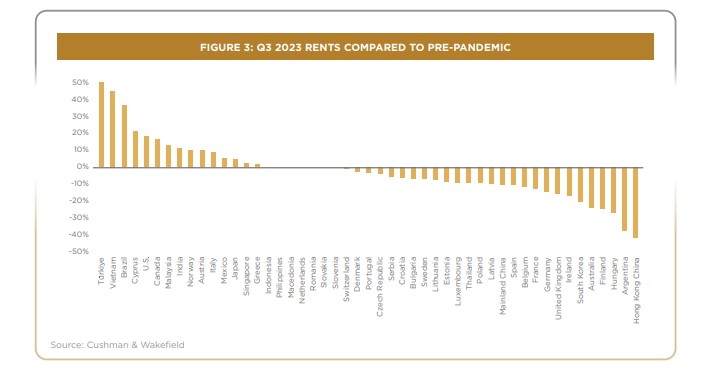

At the global level, rental declines suffered through the 2020-21 period, and continue to be clawed back such that rents are now, on average, just 0.1% below prepandemic levels—an improvement from -4.9% at Q3 2022. As noted in last year’s report, the rebound was the strongest in the U.S., which in part explains why there has been some normalisation of rental growth over the past 12 months. Notwithstanding this, 69% of the prime retail destinations analysed are above pre pandemic rents (Figure 2).

Elsewhere, while the results are positive and show an improvement, the recovery is occurring at a much slower pace. As of Q2 2022, rents across both Europe and APAC were approximately 10% below their pre-pandemic levels. Over the past 12 months, the situation has improved to 2.3% and 5.1% below pre-pandemic levels respectively, reflecting rental growth in the past year. However, 70% of European markets and 51% of APAC markets still have not recovered rental declines experienced during the pandemic. The situation remains most acute for Hong Kong, where rents declined by 45% at the peak of the pandemic and are still 42% below where they were prior to the pandemic; there has also been limited recovery in Australia. In Europe, the slowest recoveries have been seen in Hungary, Finland and across the UK and Ireland (Figure 3).

Europe: Regional Highlights

- MOST EXPENSIVE RETAIL LOCATION

Via Montenapoleone, Milan, Italy

USD1,766/sq.ft/yr - MOST AFFORDABLE RETAIL LOCATION

Makedonija Street, Skopje, Macedonia

USD33/sq.ft/yr - STRONGEST RENTAL GROWTH (YOY)

Istiklal Street, Istanbul, Türkiye

+120% (USD245/sq.ft/yr) - BIGGEST RENTAL DECLINE (YOY)

City Centre, Helsinki, Finland

-14% (USD120/sq.ft/yr)

Americas: Regional Highlights

- MOST EXPENSIVE RETAIL LOCATION

Upper 5th Avenue (49th – 60th Sts),

New York, U.S.

USD2,000/sq.ft/yr - MOST AFFORDABLE RETAIL LOCATION

Calle Florida (Av. Cordoba – Av. Corrientes)

Buenos Aires, Argentina

USD28/sq.ft/yr - STRONGEST RENTAL GROWTH (YOY)

Calle Florida (Av. Cordoba – Av. Corrientes)

Buenos Aires, Argentina

+33% (USD28/sq.ft/yr) - BIGGEST RENTAL DECLINE (YOY)

North Michigan Avenue, Chicago, U.S.

-26% (USD315/sq.ft/yr)

APAC: Regional Highlights

- MOST EXPENSIVE RETAIL LOCATION

Tsim Sha Tsui (main street), Hong Kong,

Greater China

USD1,493/sq.ft/yr - MOST AFFORDABLE RETAIL LOCATION

Anna Nagar 2nd Avenue, Chennai, India

USD22/sq.ft/yr - STRONGEST RENTAL GROWTH (YOY)

Midosuji, Osaka, Japan

+60% (USD730/sq.ft/yr) - BIGGEST RENTAL DECLINE (YOY)

SM-Railway Station area, Xiamen,

Greater China

-26% (USD131/sq.ft/yr)

3. Global Trends and Insights

Global Economic Outlook

Cost-of-living Crunch

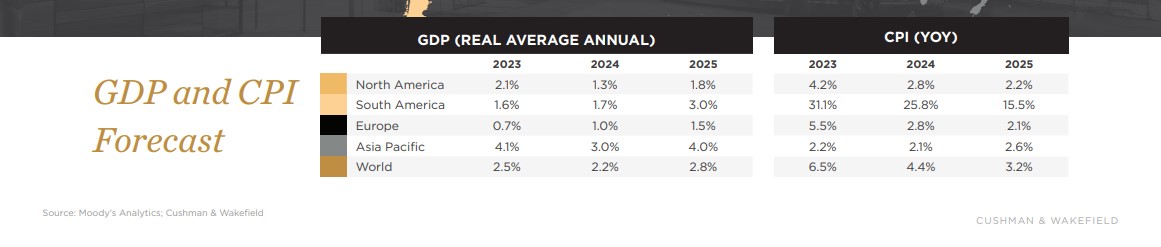

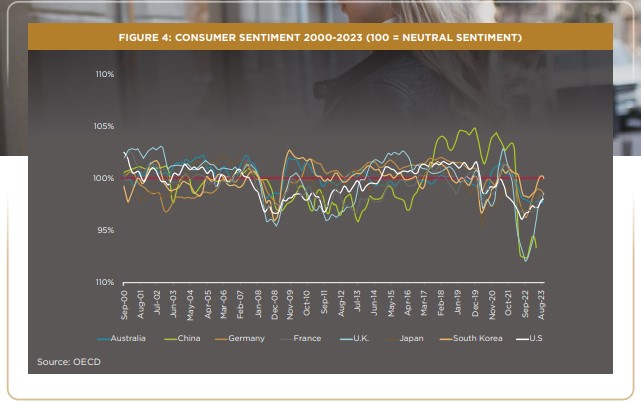

The most prevailing economic news over the past 12 months involves how the current interest rate hiking cycle has affected economic growth.

Record fiscal and monetary stimulus during the pandemic, exacerbated by supply chain bottlenecks, had caused demand to outstrip supply across numerous products and service lines which flowed into pricing and the start of a strong inflationary cycle. Central banks across many economies acted aggressively by lifting rates at a pace not seen in decades, hoping to suppress inflation by effectively making money more expensive. This had significant ramifications, from the national level down to households and individuals, as spending got reigned in. Two areas where the impacts are most clearly seen are in economic growth forecasts and consumer sentiment.

For all regions except South America, economic growth is expected to be slower in 2024 than 2023, with the U.S., UK and parts of Europe either dipping into a mild recession or skirting very close to it. Similarly, as interest rate hikes have taken effect, consumer sentiment has dampened, remaining in negative territory at levels as low as during the pandemic (Figure 4).

Against this backdrop, the retail sector has shown surprising resilience as expenditure, albeit volatile on a month-to-month basis, has largely continued to record positive, although weak, growth. Spending patterns, however, are changing. With the largest pullback seen in discretionary expenditure, households are focusing on essential items such as food, rent/mortgage and utilities. Notwithstanding this wider trend, historical evidence shows that the luxury sector performs comparatively well during economic downtowns as luxury shoppers are more immune to rising living costs.

In some markets, such as Japan, affluent consumers are turning to luxury brands as alternative forms of investment given weak returns in more traditional asset classes. Together, these factors imply a “K-shaped” outlook, with luxury and value retail offerings expected to continue growing over the near-term, while the middle, discretionary retail, is expected to enter a period of decline.

Embedding Sustainability

It may seem surprising in a sector driven by consumption, but retailers are some of the most progressive organisations when it comes to sustainability. This often starts with their supply chain, including eliminating social impacts, moving towards ethical sourcing of materials, and promoting living wages throughout their manufacturing. Most of this happens upstream from the main streets of the world, often in offshore locations.

Reducing carbon and environmental impacts is still highly relevant, however, particularly where retail property is concerned. A low carbon building is a more appealing proposition to occupy and tangible sustainability activities can be used to bring in customers. When it comes to creating attractive retail destinations for shoppers, it pays not to overlook sustainability. In fact, the highest performing retailers, such as luxury goods, will expect the highest levels of sustainability from their real estate.

Doubling Down on Experience

To say the luxury sector has not been impacted by current economic conditions, would be wrong. The latest earnings figures for major luxury retailers have generally undershot market expectations. This is undoubtedly due to at least part of their customer base, which was inflated because of pandemic-related fiscal stimulus, being eroded as households have redirected spending elsewhere.

Unfortunately, a side effect of people finding it harder to make ends meet has been an increase in the amount of crime, especially theft. In the U.S., this amounted to USD 112 billion in 2022, a 20% increase from 2021 according to the National Retail Federation.8 Such activity is occurring across a wide variety of price points—the result being margin erosion for a range of retailers. Accordingly, brands have had to increase their in-store security with a recent survey highlighting that brands are expecting to increase their security allocation budgets by an average of 28% over the next three years. Furthermore, one in five are expecting to increase their allocation by more than 40%.9 While technologies such as RFID and AI are part of the solution, the amount of in-store security personnel will also need to be increased. Of course, the challenge is how to achieve greater security without impinging on customer experience.

Luxury shoppers are focusing more closely on experiences as more conspicuous items are being seen as increasingly taboo given wider economic pressures. Such transformation is manifesting in different ways. Brands themselves are expanding into new sectors including hotels, residences, interior design and hospitality as they double-down on experience. Such moves have seen the rise of Armani/Casa, Bulgari Hotels and Resorts as well as LVMH’s Cheval Blanc Hotels. Changes have been evident in the tenant mix on main streets, with beauty services and cosmetics, for example, becoming more prominent. Such growth highlights the level of nuance within the luxury sector.

More widely, fashion, sports and athleisure brands have also become more focused on curating high quality in-store experiences, having made significant investments into their flagship stores. At the root of “experience” is the need for high quality staff, and here brands again are being challenged. Despite the wider economic slowdown, labour markets across the world remain exceptionally tight, which has fuelled a wage price spiral in some economies. More widely, labour has become increasingly disrupted as more strikes have occurred in the U.S. and much of Europe. As a result, talent retention and recruitment remain a top priority. Employees serve as brand ambassadors, representing the brand’s values and contributing significantly to the shopper experience and therefore the company’s long-term success.

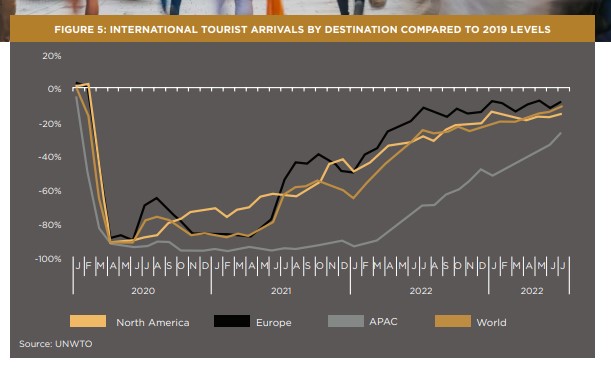

International Travel

The international travel market was severely impacted during 2020 and 2021, with global passenger movements down as much as 87% from 2019 levels. Recovery started in 2022 and fortunately has been maintained into 2023, such that at the global level, international passenger movements as of July 2023 were down only 10% from 2019 levels (Figure 5). Europe continues to lead the way, while the recovery is taking longer in Asia Pacific which is still down 25%. As yet, there has not been a substantial return to travelling by Chinese international tourists.

The World Tourism Alliance has estimated that there were a little over 40 million international outbound tourists from China in H1 2023, which, when annualised, sits at 50% below pre-pandemic levels. In contrast, domestic tourism in China is sitting at almost 90% as the government has sought to promote the sector. Notwithstanding this slower pace of recovery, so far Southeast Asian destinations have been the key beneficiaries as Chinese tourists have holidayed within the region. More markets, however, have reintroduced group visas as well as seeking to resolve other infrastructure issues which will help drive full recover—which is forecast by 2025 (Oxford Economics).

E-commerce: Only One Part of the Equation

E-commerce continues to attract significant attention as more retailers expand their online presence. For example, online sales for Zara have grown from 10% of revenue in 2017 to over 25% in 2022, reaching almost EUR 8 billion.

This is partly a reflection of generational change as Generation Z (born 1996 to 2012) becomes a more important part of the consumer class. The spending of Generation Z is set to grow three times faster than other generations for the remainder of the decade,10 which means future growth in e-commerce is all but assured. When it comes to luxury, luxury brands were initially slow to incorporate “online” into their service offerings, but many increased their e-commerce activity in response to the demand. While online sales for luxury brands grew 20% YOY in 2022, however, the market share remained at 2021 levels, further proving e-commerce is only one part of the equation.

Brands will also need to factor in higher costs across social media advertising to grow greater levels of online sales. It is estimated that online customer acquisition costs have increased 60% in the last five years,11 which is further eroding brand profitability, and contributing to a forecast 33% increase in global digital advertising spending by 2026.12 Increased consumer privacy legislation is also making it more complicated.

Altogether, these factors reinforce the importance of maintaining a physical presence in key markets and underpin why luxury brands continue to expand their footprints as well as maintain extensively refurbished retail stores. These stores are the physical embodiment of the brand, something that is very hard to curate in an online environment.

Often this is reinforced with bespoke products only available for purchase in-store to channel customers into real world retail experiences. It is for this reason that the fitting out of new stores is undertaken with meticulous attention to detail through centralised decision-making to ensure adherence to design guidelines, and why physical stores will remain a critical part of a luxury brand’s equation.

Download the text HERE.