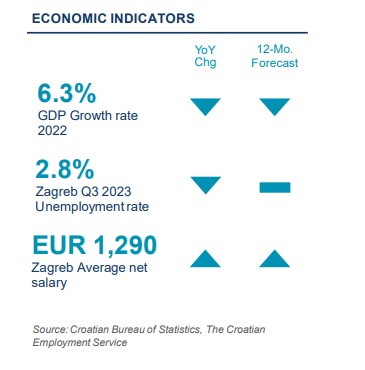

ECONOMY

The Croatian National Bank’s June projection maintains an unaltered forecast for the growth of the Croatian economy, holding steady at 2.9% for the year 2023. However, a potential deceleration in growth is envisaged, with anticipated growth rates of 2.6% in both 2024 and 2025. This projection implies a moderation in the growth trajectory, indicating evolving market conditions. Inflationary pressures, after a momentary spike in August linked to escalated energy prices, are forecasted to continue their downward trajectory.

Expectations suggest a decline from the 10.7% inflation rate recorded in 2022 to an estimated 8.8% in 2023. Subsequent years demonstrate a further decline, with the inflation rate projected to decrease to 4.7% in 2024 and 2.4% in 2025.

The reduction in inflation in 2023 is predominantly attributed to the declines in energy-related inflation. Notably, despite recent upward pressure due to limited crude oil supplies in the global market, the trend suggests a downward movement in the inflationary landscape. The tourism sector continues to play a robust and influential role in the Croatian Gross Domestic Product (GDP).

Data sourced from the Croatian Tourist Board and eVisitor reports affirm this, with Croatia registering 16.2 million arrivals and 88.5 million overnight stays during the initial eight months of 2023. Comparing this to the same period last year, there is an 8% increase in arrivals and a 2% rise in overnight stays. Moreover, these statistics are almost at par with the figures from 2019.

SUPPLY AND DEMAND

The third quarter of 2023 marked the completion of the Radnička 75 business building project that was completed in September, totaling 3,300 sq m of office space. The imminent completion of the Grawe Garden Center by the end of 2023 is set to contribute an additional 2,100 sq m of office space. Several ongoing and planned projects are positioned to significantly impact on the market. A new Matrix D office building, totaling 10,500 sq m of GLA started with preconstruction works. Completion is targeted in Q4 2024.

A new office project, the Supernova Office Towers, is set to be developed within the business district of Buzin. Scheduled for completion in Q4 2024, it is expected to add 15,300 sq m of office space. Furthermore, the announcement by the VMD Group regarding the construction of a new office tower in Heinzelova Street, totaling 15,000 sq m of office area, is anticipated to impact the market upon its completion in 2025.

In the third quarter of 2023, the occupier activity remains very stable with a positive outlook. Total take-up during this period reached a significant 13,715 square meters, with an average deal size of 590 square meters. Upon analysis per sector, the Computers & Hi-Tech sector emerged as the primary driver, accounting for over 42% of the total take-up.

Following closely were the Manufacturing and Consumer sectors, contributing 16% each to the overall occupier activity. This surge in occupier activity signifies a highly active market landscape, particularly evident when considering the cumulative occupier activity for the entire year of 2023. The total occupier activity in 2023 reached to 56,000 square meters, marking a substantial 42% increase compared to the occupier activity observed during the first three quarters of 2022. This considerable year-over-year increase underlined the strong and rising dynamic within the market, signifying continued and prominent growth in occupier engagements and commitments within the real estate sector.

RENTS AND VACANCY

The asking rents for Class A office buildings remained at the level of EUR 13.5-15.5/sq m/month, while the asking rents for Class B office premises amount to EUR 11-13/sq m/month. However, new office buildings, situated at the most attractive locations, can achieve asking prices between EUR 16- 17.50/sq m/month. Due to the new deliveries on the market overall vacancy rate mildly increased to the level of 2.00%, while the vacancy for class A buildings dropped to the level of 1.37%. Location-wise, CBD remains the most preferred business area with 65% of deals in Q3 being signed within Zagreb’s CBD zone.

You can download the text HERE.