ECONOMY

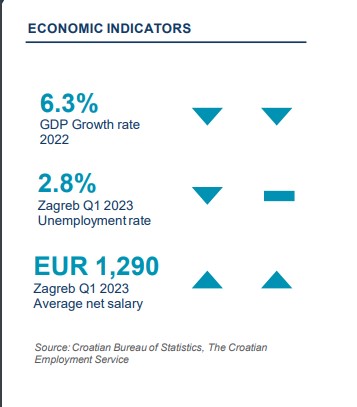

Croatia’s GDP growth slowed down in the first quarter of 2023, following the surge in energy prices and uncertainty over the war in Ukraine, although the mild and late winter supported construction activity and reduced the drag from high energy prices, moderating the slowdown. Moreover, the World Bank in June 2023, revised its forecast, as it expects Croatia’s economy to grow by 1.9% in 2023, up 1.1 % compared to the bank’s previous prediction made in January.

The new forecast is supported by the growth that is expected to gather pace in 2024-25, partly owing to increased use of funding from the EU Recovery and Resilience Facility (RRF), made available to Croatia as a new member of the euro area since January 2023. According to the Croatian National Bank in the first five months 2023, inflation slowed down continuously reaching 7.9% in May 2023. In the first half of 2023, 16% more tourist arrivals was generated, as well as 10% more overnight stays in Croatia, than in H1 2022, according to Croatia’s e-visitor registration system data.

SUPPLY AND DEMAND

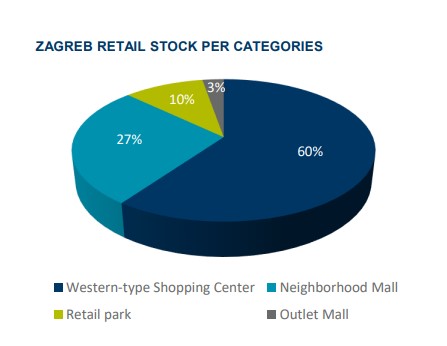

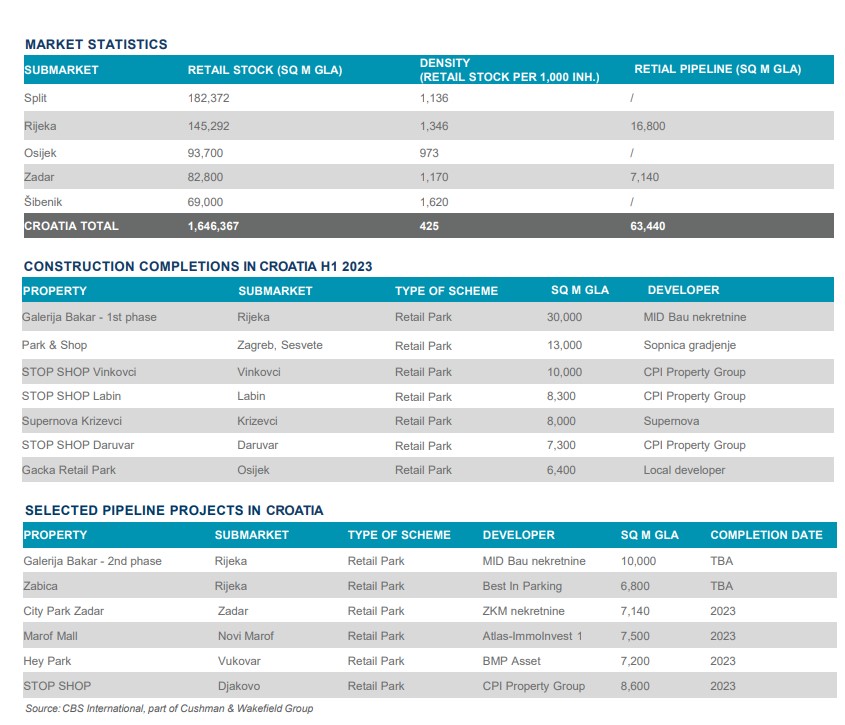

Similar to other markets in the region, where the development activity in retail sector is primarily focused on the development of retail parks and convenience schemes at the secondary locations, Zagreb and Croatia are following the same trend. In the first two quarters of 2023, 6 retail parks were opened across Croatia, enlarging the stock for new 70,300 sq m of retail space, while modern retail supply in Zagreb was boosted by the opening of retail park named Park & Shop in Sesvete area, totalling 13,000 sq m. Moreover, 63,000 sq m of retail park stock is currently under development, which confirms their dominance. On the other side, there were no changes in shopping centre stock and with no new openings planned in 2023. At the end of the first half in 2023, Zagreb modern supply amounts to 555,000 sq m of GLA, while Croatia modern stock increased to the level of 1,646,000 sq m of GLA.

Smaller cities across Croatia, in majority of cases, miss shopping centres at all and the most attractive retail destinations in these cities are the main pedestrian zones, while certain portion of retail supply is offered within big box schemes. Therefore, retail parks have proved to be dominant and most popular retail formats in the previous few years, especially at the secondary and tertiary locations across the country. As a result, a share of retail park formats is on constant rise and currently amounts to 27%.

RENTS AND YIELDS

The leading Zagreb shopping centres maintain a rather stable level of rents during the first six months of 2023, ranging between EUR 30-45/sq m/month. Prime yields for retail properties in Zagreb also remained at the similar level, i.e., 7.25% for modern shopping centres and 8.00- 8.50% for retail parks, while the prime yields for high-street locations stayed at the level of 7.00%. It could be expected that yields for prime SC will be subjected to upward pressure in the following period, in accordance with the tightening of monetary policy.

Download the text HERE.